Update: Connected TV (CTV) and Premium Online Video are #1 in ROAS

Posted by Field Garthwaite | Aug 20, 2020 | Contextual Video,Announcements |

I am writing to share previously unreleased data on the trends across Connected TV (CTV) and Premium Online Video along with an update on IRIS.TV's marketplace growth driven by demand for contextual and brand-safe CTV targeting.

Research shows CTV and Premium Online Video delivers higher Return on Ad Spend (ROAS) than TV, and significantly higher ROAS than social media. Scaling CTV investment has been challenging due to privacy regulations, fragmented supply sources, and a lack of scalable solutions for marketers to achieve reach and frequency goals.

Despite the success of contextual targeting in search and display, there was no solution for contextual targeting on CTV until IRIS.TV launched our Contextual Video Marketplace. Today, one year later, IRIS.TV is experiencing exponential growth. We are pleased to announce that through our work with publishers, broadcasters, brands, agencies, and the entire programmatic technology ecosystem there is now a solution that enables programmatic CTV and video investment at scale.

Here are three major trends associated with this breakthrough:

1. The Future of the Upfront: CTV and Premium Online Video are #1 in ROAS

New research is driving brands to re-evaluate their video investment strategy on social and TV. This is happening in parallel with marketers pulling social video investment due to brand safety issues and campaigns like #stophateforprofit and #nodenyingit.

2. Growing demand for contextual targeting on CTV and OLV

Advertisers are demanding transparency to guarantee that their campaigns are brand-safe and suitable, not just at the page or social channel level—but for each video and ad pod.

3. Rapid growth of contextual targeting for programmatic CTV and OLV

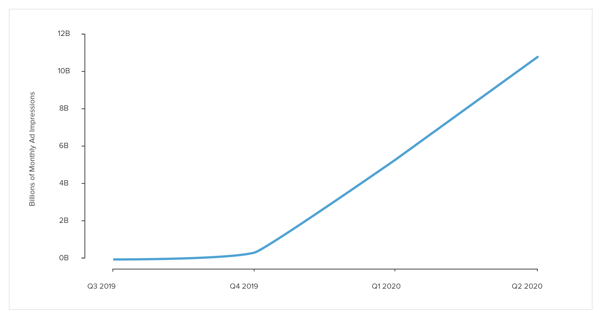

Contextual targeting is now available across 10B+ monthly video impressions. IRIS.TV's Contextual Video Marketplace grew 563% in Q2 alone.

1. The Future of the Upfront: CTV is #1 in ROAS

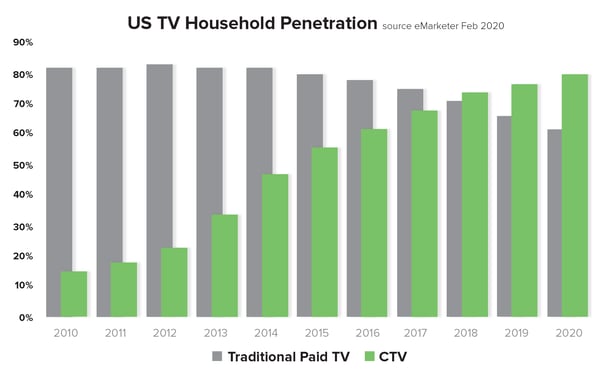

CTV has eclipsed Cable TV and the global pandemic has both accelerated the decline of pay TV and the growth of video.

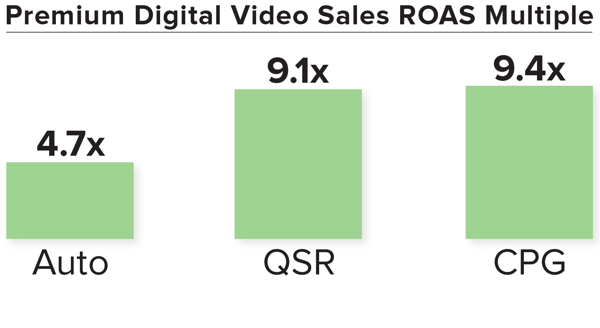

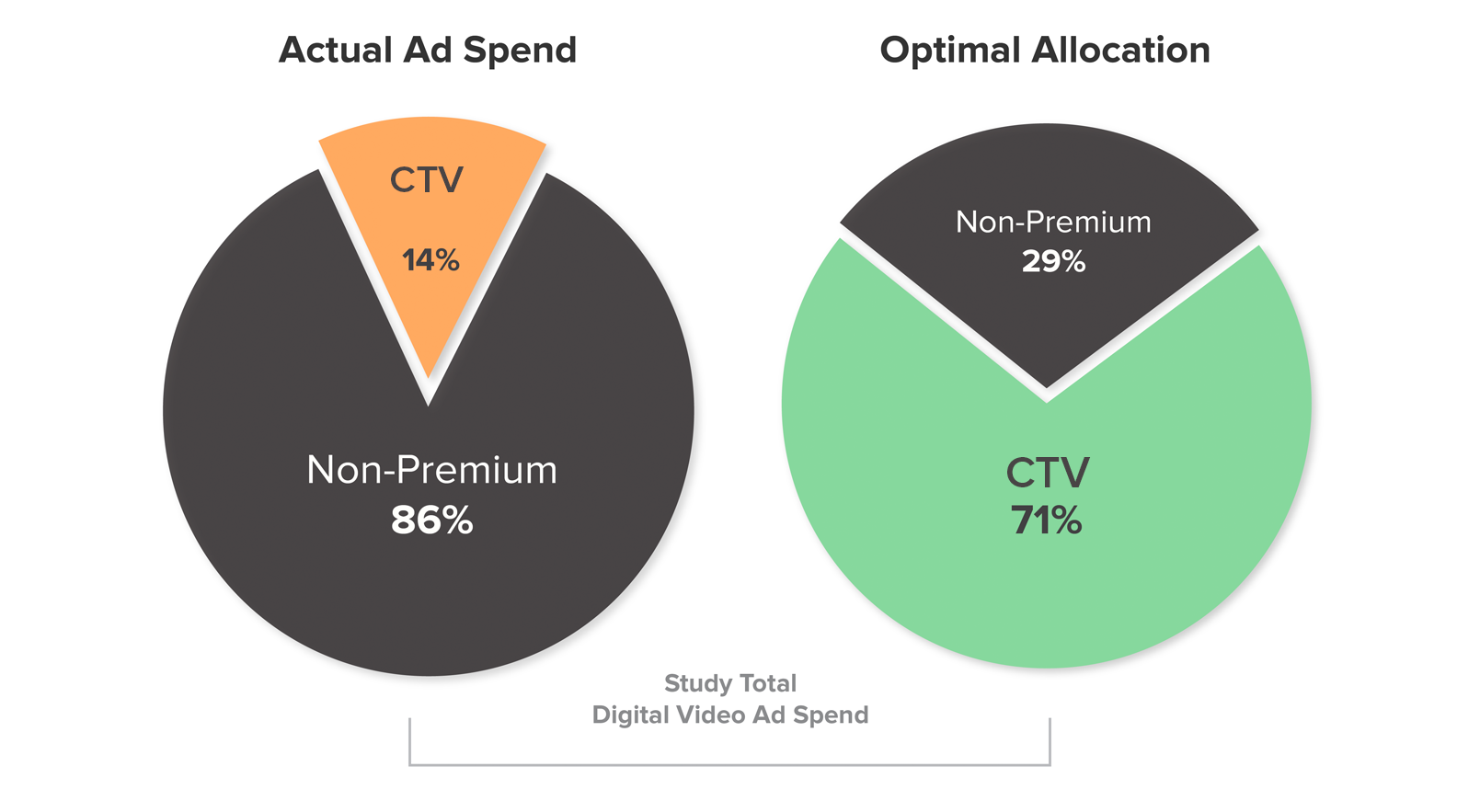

Research conducted by Fox found that CTV and Premium Online Video generates 4x-10x higher ROAS than TV, and TV is significantly higher than YouTube and Facebook. The study connected $48 billion dollars of ad spending with $2.2 trillion dollars of consumer spending across Auto, Quick Service Restaurants (QSR) and Consumer Packaged Goods (CPG).

*Compared with TV at 1x ROAS, YouTube/Facebook were <1X (Non-Premium Video)

**https://www.billharveyconsulting.com/Multiplatform_ROAS.pdf

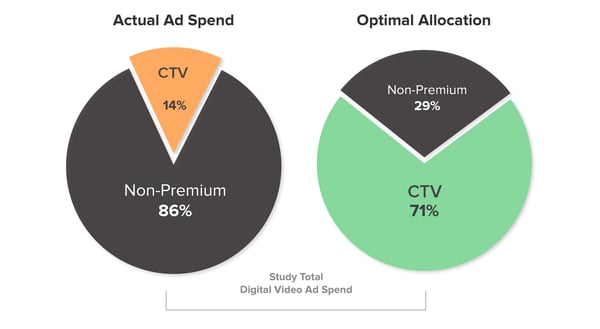

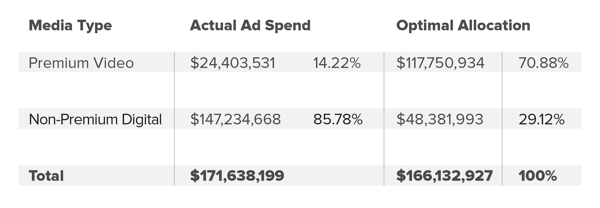

Programmatic buyers expect transparency when targeting search and display ads based on the contextual nature of web pages for safety and suitability. Broadcasters and CTV publishers, however, have not made episode level data available until it can be packaged in a way that is both effective for supply side sales teams and media buyers. By being able to transact on contextual data for each video and ad pod for Full Episode Players (FEP), buyers can now purchase with a level of transparency that is consistent with search and display—with higher efficiency and ROAS than buying specific episodes or TV shows.

*Non-Premium Video refers to YouTube, Facebook, and out-stream supply

2. Growing Demand for Contextual Targeting on CTV and Online Video

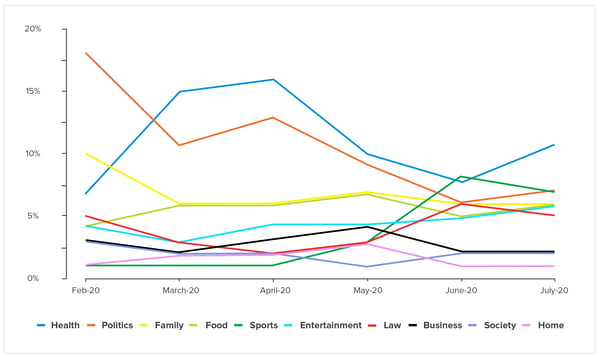

Over the last few months from the start of the pandemic, we’ve observed what video categories buyers are investing in across web, mobile, and CTV. The largest investment in Q2 has come from the CPG, Automotive, Healthcare, and Technology sectors targeting News, Entertainment, Health, Family, and Sports.

Top 10 Viewed Brand-Safe Categories from the IRIS.TV Contextual Video Marketplace

Top viewed videos as a percentage of total impressions across all categories

3. Rapid Growth of Contextual Targeting for CTV

As the industry prepares for a cookieless future, it needs greater transparency in CTV and premium online video. At IRIS.TV we are seeing this first-hand through the exponential growth of our Contextual Video Marketplace.

Publishers are enabling their video inventory for contextual and brand-safe targeting at scale.

By being neutral and connecting the world's video content with contextual and brand safety data segments, IRIS.TV is enabling transparency into CTV and Premium Online Video. Contextual targeting is now available across 10B+ monthly video impressions.

Exclusive: Data Insights for CTV and Premium OLV

IRIS.TV will be releasing an insights product for:

- Publisher and broadcaster sales teams

- Agency research and planning teams

- Trading desk and investment teams

This product will be released in Alpha to 50 companies so that we can work closely with multiple stakeholders in each customer organization to inform our product development

Sincerely,

Field Garthwaite

CEO & Co-Founder, IRIS.TV

.jpg)

.png)

.png)